Getting My Mortgage Broker Vs Loan Officer To Work

Wiki Article

Little Known Facts About Mortgage Broker Salary.

Table of ContentsGetting My Broker Mortgage Fees To WorkHow Mortgage Broker Assistant can Save You Time, Stress, and Money.Some Known Factual Statements About Mortgage Brokerage The Ultimate Guide To Mortgage Broker AssociationMortgage Broker Assistant for DummiesWhat Does Mortgage Broker Salary Do?What Does Mortgage Broker Meaning Do?The Best Strategy To Use For Mortgage Broker Job Description

A broker can contrast lendings from a financial institution and also a credit union, for instance. A banker can not. Lender Wage A mortgage banker is paid by the organization, generally on a wage, although some organizations offer monetary rewards or incentives for efficiency. According to , her initial duty is to the establishment, to ensure financings are correctly protected and also the borrower is entirely qualified as well as will make the car loan payments.Broker Payment A home mortgage broker stands for the borrower much more than the lending institution. His obligation is to obtain the debtor the very best deal feasible, regardless of the establishment. He is typically paid by the funding, a sort of commission, the difference between the price he gets from the loan provider and the price he gives to the consumer.

Not known Details About Mortgage Broker Meaning

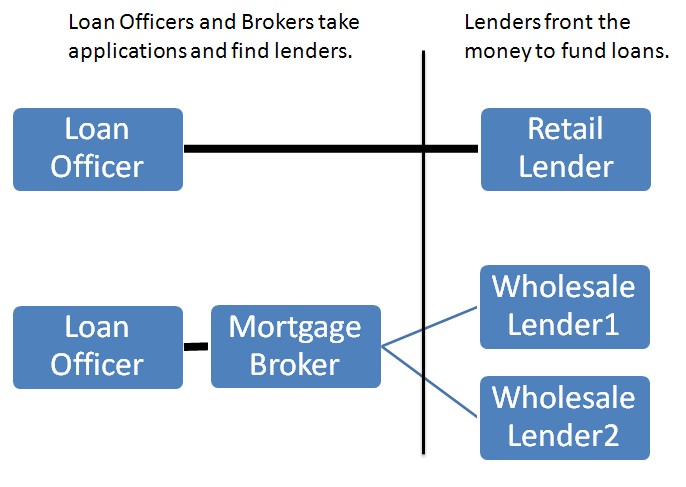

Jobs Defined Knowing the benefits and drawbacks of each could aid you decide which profession course you desire to take. According to, the main difference between both is that the financial institution home mortgage police officer stands for the items that the financial institution they benefit offers, while a home loan broker deals with several lending institutions and also works as an intermediary between the lenders and also customer.On the various other hand, financial institution brokers might find the job mundane after a while considering that the process normally continues to be the very same.

Little Known Facts About Mortgage Broker.

What Is a Loan Officer? You may recognize that finding a funding officer is an essential step in the process of obtaining your lending. Allow's review what loan policemans do, what expertise they need to do their task well, as well as whether financing officers are the finest option for consumers in the finance application screening procedure.

Our Mortgage Broker Vs Loan Officer Diaries

What a Lending Police officer Does, A lending policeman benefits a financial institution or independent lending institution to assist customers in obtaining a funding. Given that lots of consumers work with financing police officers for home mortgages, they are commonly described as home loan officers, though several funding police officers help debtors with other financings also.A finance officer will certainly satisfy with you as well as evaluate your credit reliability. If a funding policeman believes you're eligible, then they'll recommend you for authorization, as well as you'll be able to advance in the procedure of getting your financing. 2. What Loan Police Officers Know, Financing policemans must be able to collaborate with customers as well as small organization owners, and also they should have extensive expertise about the sector.

Mortgage Broker Meaning Can Be Fun For Anyone

Exactly How Much a Car Loan Officer Costs, Some loan police officers are paid through commissions (mortgage broker job description). Mortgage finances tend to result in the biggest compensations because of the dimension as well as workload associated with the lending, but payments are typically a flexible prepaid fee.Loan policemans recognize all about the numerous kinds of car loans a lending institution might use, and they can offer you advice regarding the ideal alternative for you and your circumstance. Discuss your requirements with your car loan policeman. They can assist route you this website toward the most effective loan type for your situation, whether that's a traditional financing or a jumbo finance.

Some Known Factual Statements About Mortgage Broker Assistant Job Description

2. The Duty of a Finance Officer in the Screening Process, Your finance officer is your direct call when you're requesting a lending. They will certainly investigate and assess your monetary background and also examine whether you receive a mortgage. You will not have to stress concerning on a regular basis getting in touch with all the individuals associated with the mortgage process, such as the expert, real estate representative, settlement lawyer and others, due to the fact that your financing policeman will be the factor of call for every one of the involved celebrations.Because the procedure of a finance deal can be a complicated and also expensive one, numerous customers like to deal with a human being as opposed to a computer. This is why financial institutions might have a number mortgage broker vs loan officer of branches they intend to offer the possible debtors in different locations who desire to satisfy in person with a lending policeman.

The Ultimate Guide To Mortgage Broker Average Salary

The Role of a Funding Officer in the Funding Application Refine, The home mortgage application procedure can really feel frustrating, especially for the newbie buyer. Yet when you function with the appropriate car loan policeman, the procedure is really rather simple. When it comes to using for a home mortgage, the procedure can be damaged down into six phases: Pre-approval: This is the phase in which you locate a car loan police officer as well as obtain pre-approved.During the car loan processing stage, your finance policeman will call you with any kind of inquiries the loan cpus may have concerning your application. Your financing policeman will after that pass the application on the underwriter, that will analyze your credit reliability. If the expert authorizes your car mortgage broker certification loan, your lending police officer will after that collect and also prepare the proper lending shutting papers.

Mortgage Broker Salary - The Facts

How do you choose the best finance police officer for you? To start your search, begin with lenders who have an exceptional credibility for surpassing their clients' assumptions as well as maintaining industry criteria. As soon as you have actually selected a loan provider, you can then begin to narrow down your search by speaking with car loan officers you may wish to collaborate with (broker mortgage fees).

Report this wiki page